One of the sources of the Pension Fund's funds is revenues from the payment of the single contribution (SSC) for compulsory state social insurance. The single contribution for compulsory state social insurance (SCI) combines compulsory contributions for pension insurance, unemployment insurance, temporary disability insurance, industrial accident insurance, and occupational disease insurance.

Payers of the single contribution are required to pay SSC in the amount of 22% of the calculation base (salary, remuneration for work performed or services provided).

An employee's right to social protection depends on the payment of the single social contribution and the acquired insurance period:

🔹 pension assignment;

🔹 sick pay;

🔹 unemployment benefits;

🔹 benefits in the event of an accident at work or occupational disease.

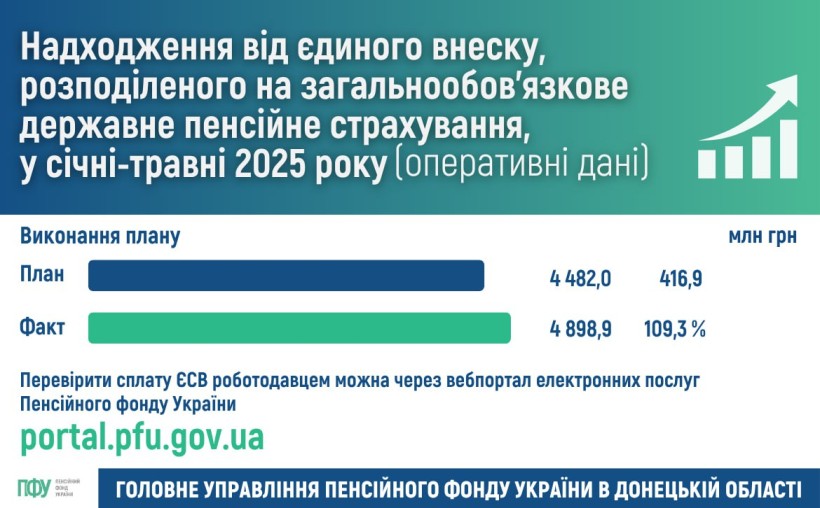

Check the formalization of your employment relationship, the timeliness and completeness of insurance contributions, and the length of your insurance record on the Pension Fund of Ukraine's e-services web portal https://portal.pfu.gov.ua

Find out how to obtain electronic certificates with a QR code (on earnings for pension calculation, insurance period, pension amount, etc.) https://t1p.de/xkzwy.