The Ministry of Finance of Ukraine, together with the State Tax Service, is conducting a communication campaign called "Taxes Protect." A series of infographics and videos describe various real-life situations that will teach you about:

- the most common tax situations for Ukrainian citizens and the corresponding taxes,

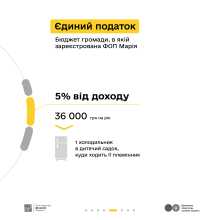

- the procedure for their payment and distribution between the state and local budgets,

- where the state spends the taxes paid by citizens,

- the consequences of non-payment of taxes.

Read on to learn about a real-life situation—how blogger Maria pays taxes on her income from advertising on TikTok.

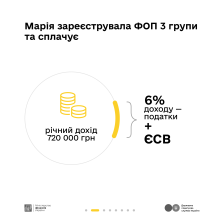

Imagine Maria. She is 22 years old and runs a popular blog on TikTok. By advertising Ukrainian and foreign brands, Maria earns about UAH 60,000 per month (UAH 180,000 per quarter, UAH 720,000 per year). To legalize her income, she registered her activity as a sole proprietor (individual entrepreneur) of the 3rd group. This allows her to officially provide advertising services and receive payment from both Ukrainian and foreign companies.

Every quarter, Maria submits a tax return through the My Tax app and pays taxes and mandatory insurance contributions.

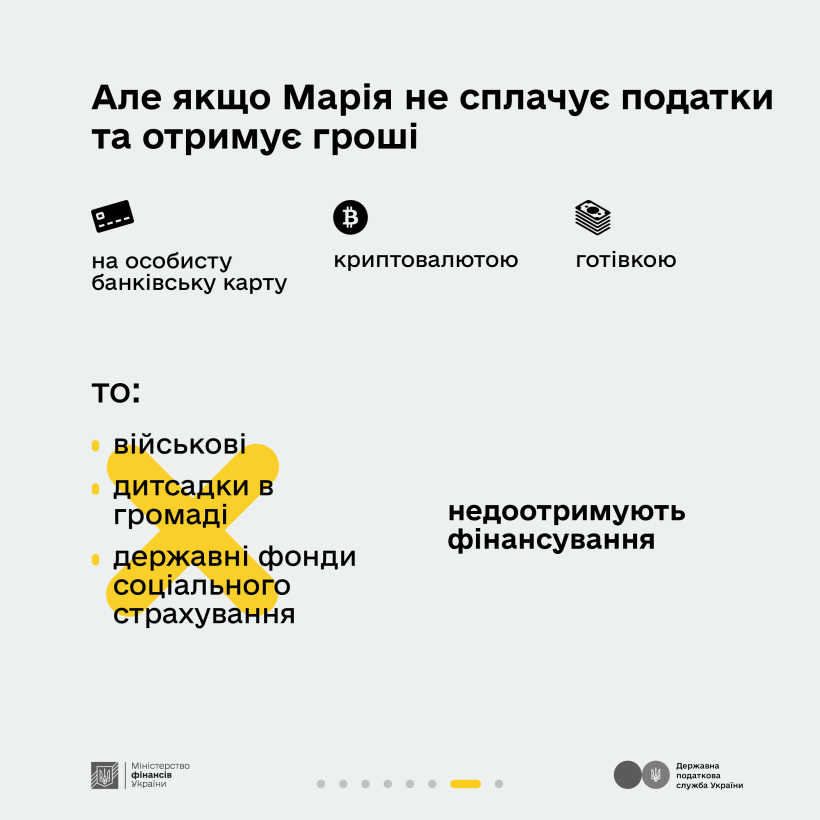

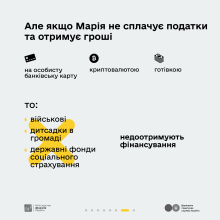

If Maria evades paying income tax and receives payment for her advertising services to her personal bank card, in cryptocurrency, or in cash, then:

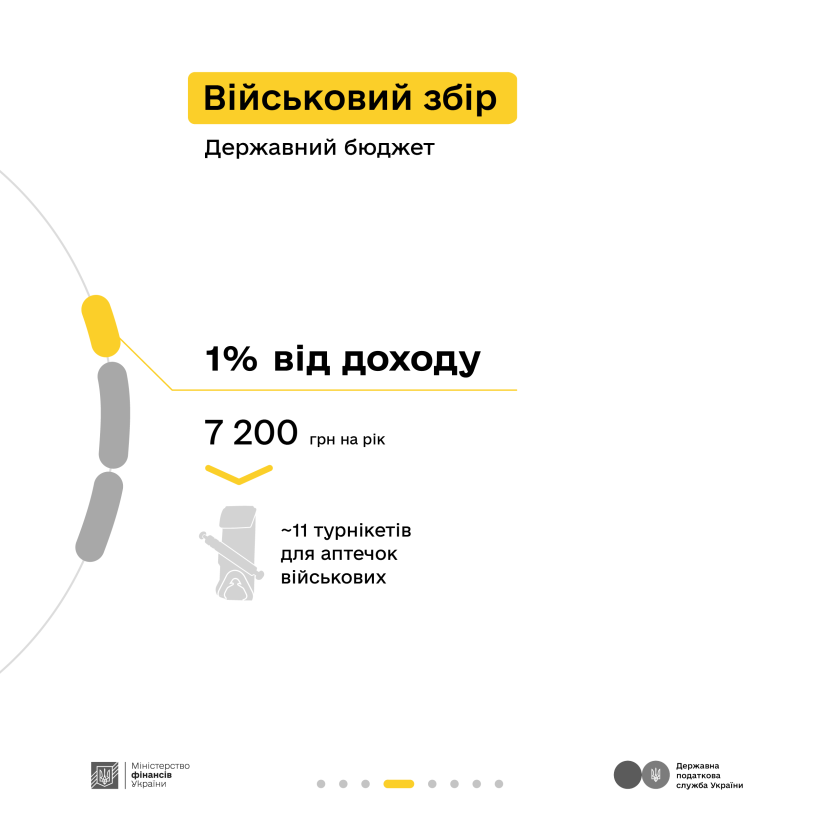

- Ukrainian military personnel may be left without high-quality tourniquets to quickly stop bleeding and save the lives of their comrades.

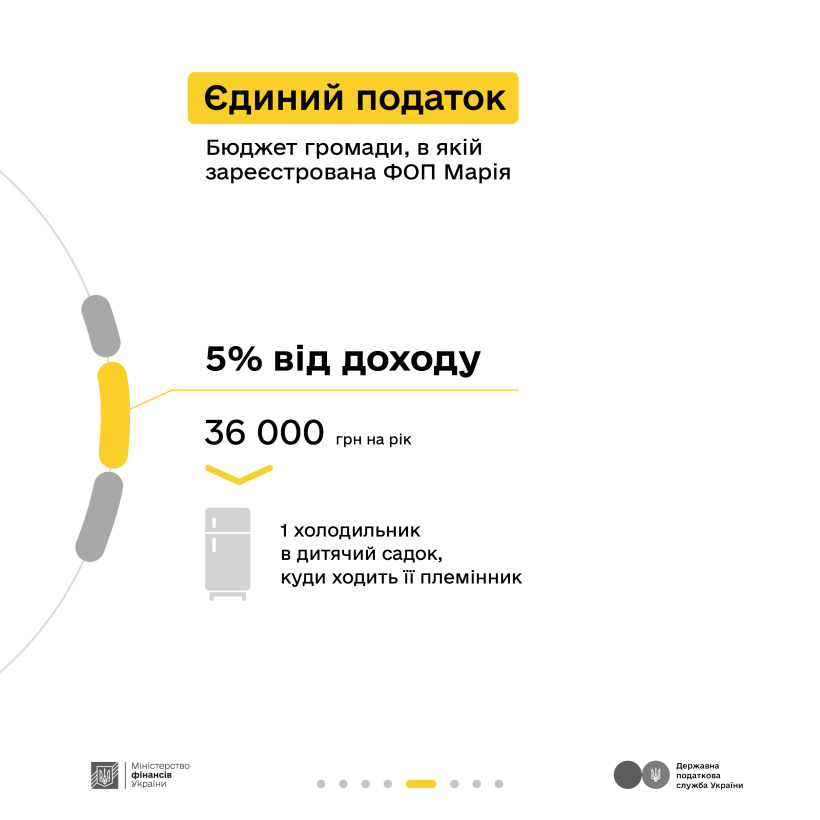

- kindergartens will not be able to replace old Soviet refrigerators, and food will quickly spoil,

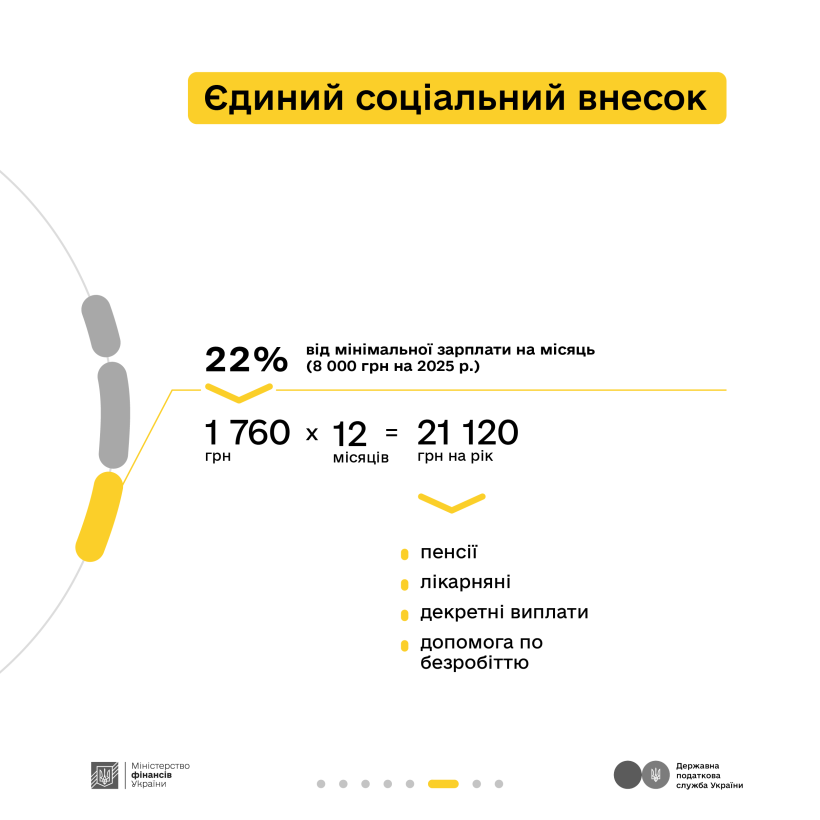

- state social insurance funds will not receive sufficient funding, so Maria may be left without the necessary social guarantees and benefits if needed.

Taxes protect. Help with your contribution!