The Ministry of Finance of Ukraine, together with the State Tax Service, is conducting a communication campaign called "Taxes Protect." A series of infographics and videos describe various real-life situations that will teach you about:

- the most common tax situations for Ukrainian citizens and the corresponding taxes,

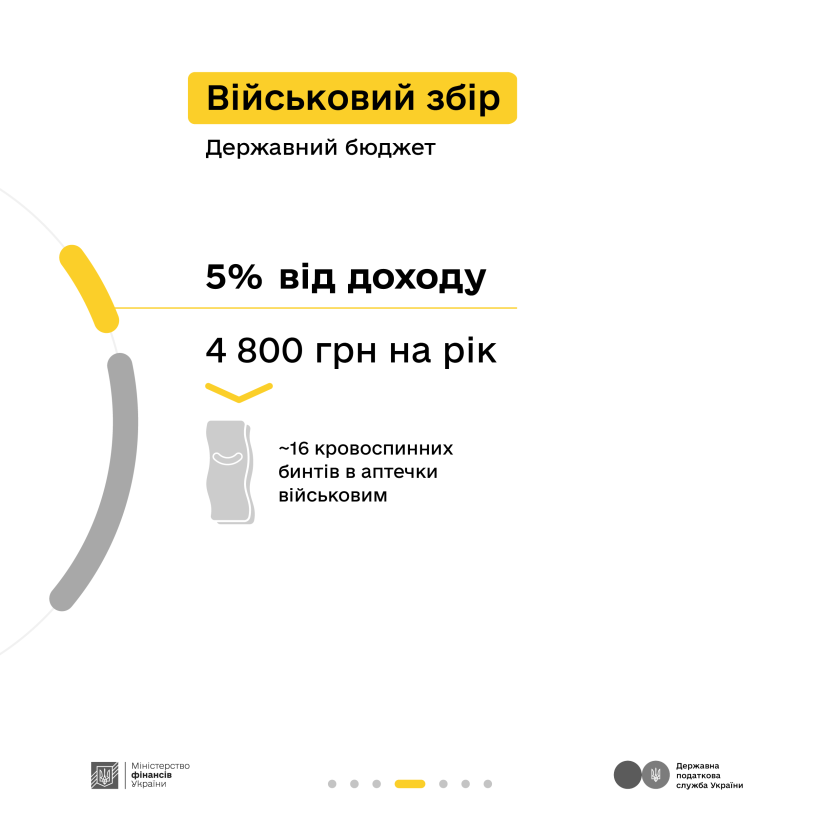

- the procedure for their payment and distribution between the state and local budgets,

- where the state spends the taxes paid by citizens,

- the consequences of non-payment of taxes.

Read about this real-life situation and find out what taxes Yuriy pays on his profits from selling cryptocurrency.

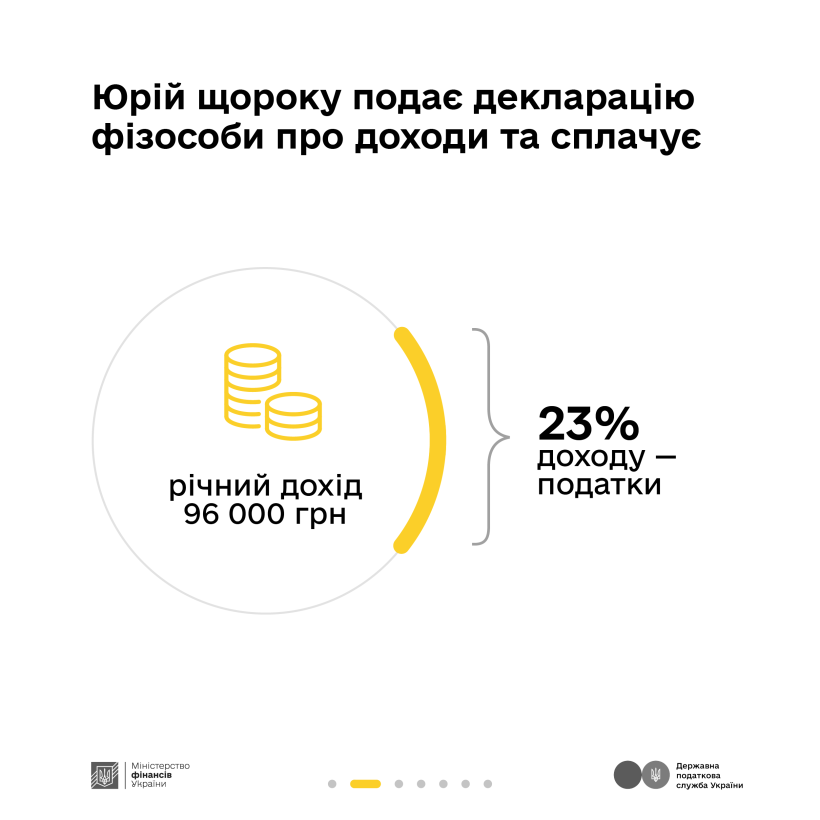

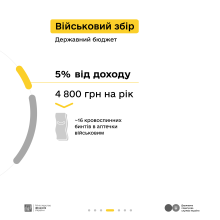

20-year-old Yuriy figured out cryptocurrency, registered on an exchange, and follows market fluctuations. Every month, he earns about UAH 8,000 (UAH 24,000 per quarter; UAH 96,000 per year) from cryptocurrency trading.

To legalize his income, Yuriy submits an individual tax return for income received in the previous year through the Electronic Taxpayer's Office on the State Tax Service web portal by May 1 each year and pays taxes.

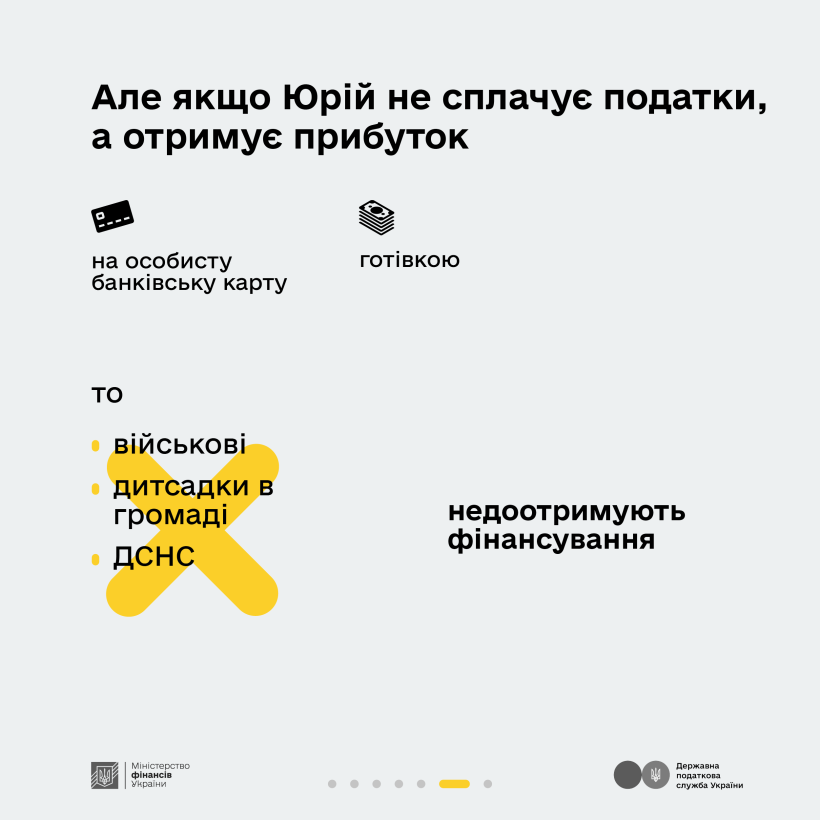

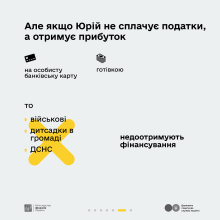

If Yuriy does not declare his income and trades cryptocurrency through "gray" platforms, receives profits in cash or as a P2P transfer to a bank card, and does not pay taxes, then:

- soldiers will not have tourniquets to stop bleeding in their comrades and save their lives;

- the State Emergency Service brigade will not be able to extinguish fires after shelling;

- community kindergartens will be underfunded.

Taxes protect. Help with your contribution!