The Ministry of Finance of Ukraine, together with the State Tax Service, is conducting a communication campaign called "Taxes Protect." A series of infographics and videos describe various real-life situations that will teach you about:

- the most common tax situations for Ukrainian citizens and the corresponding taxes,

- the procedure for paying them and their distribution between the state and local budgets,

- where the state spends the taxes paid by citizens,

- the consequences of tax evasion.

Read about a real-life situation and find out what taxes master craftsman Mykhailo pays on his income from laying tiles.

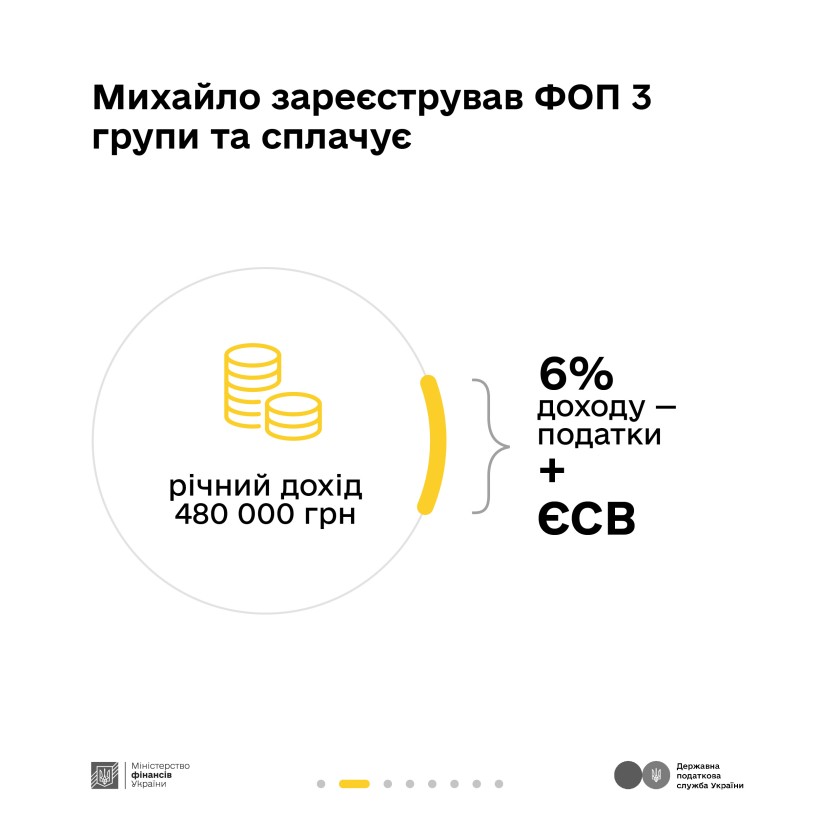

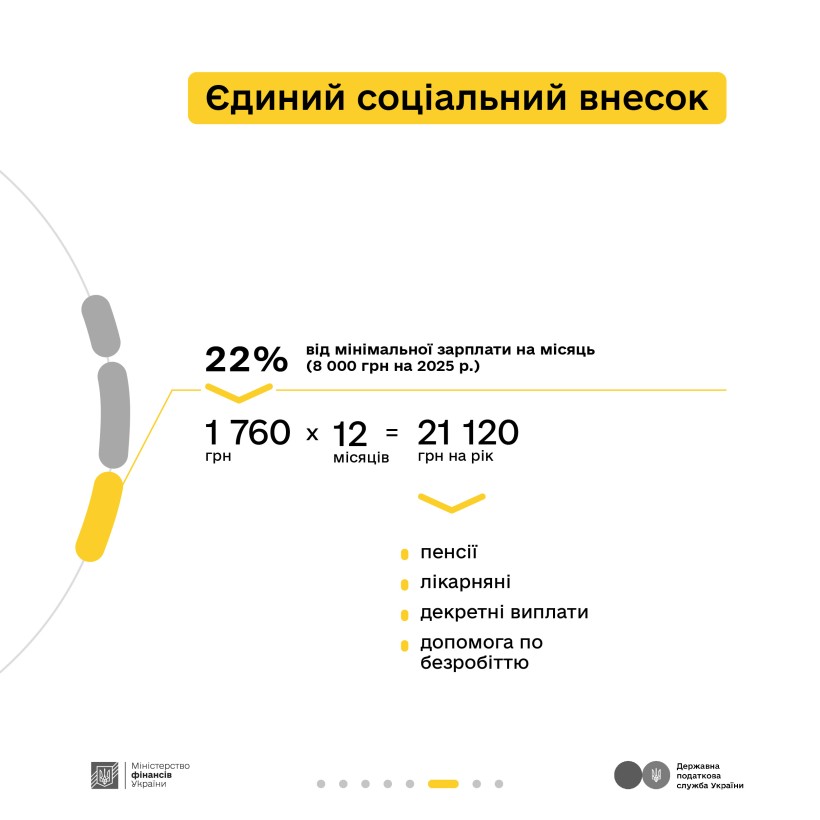

Mykhailo, 27, is a master tiler. He finds his orders through online ads and recommendations from previous clients. On average, Mykhailo earns about 40,000 UAH per month (120,000 UAH per quarter; 480,000 UAH per year). To legalize his income, Mykhailo registered his activity as a sole proprietor (individual entrepreneur) of group 3. This allows him to officially provide tile laying services to both individuals and construction companies.

Every quarter, Mykhailo submits a tax return through the "Dія" app and pays taxes.

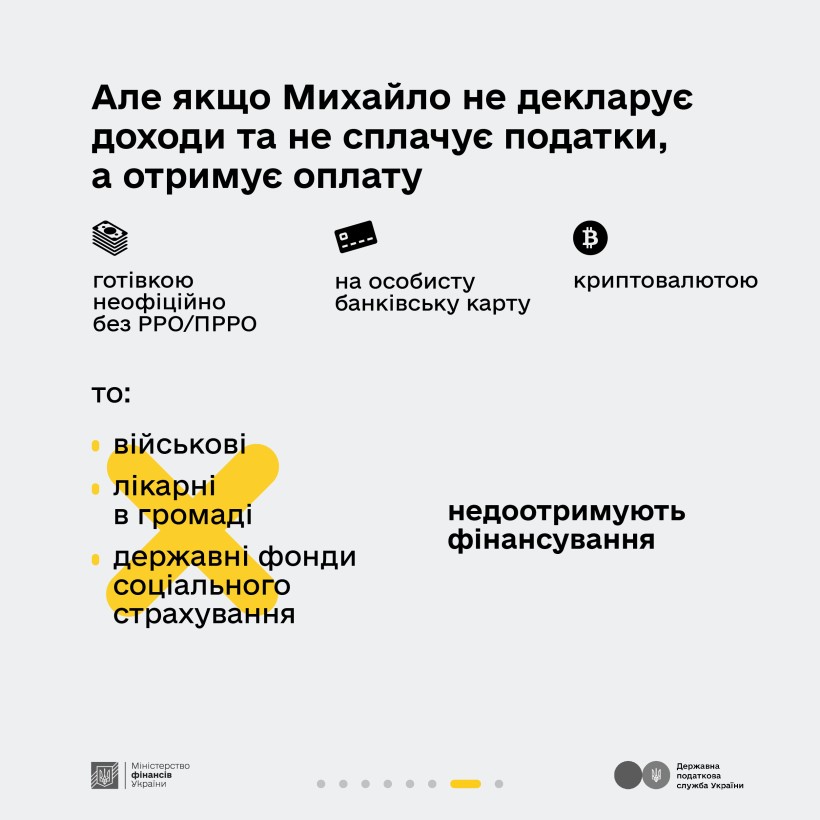

If Mykhailo receives payment for his services on his personal bank card, in cryptocurrency, or in cash and does not declare it, it turns out that he does not pay taxes on his income. Then:

- the military will not have enough food when they go out on missions,

- doctors will not be able to perform cardiograms on patients in intensive care,

- state social insurance funds will not be replenished, and therefore Mykhailo will not receive the appropriate payments when needed.

Taxes protect. Help with your contribution!