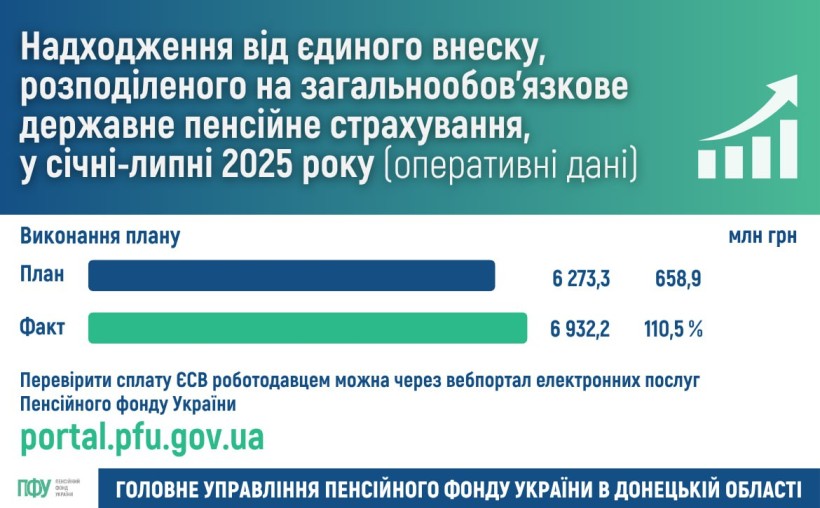

ℹ One of the key sources of funding for the Pension Fund is the revenue generated from the payment of the Unified Social Contribution (USC) to the mandatory state social insurance system.

👉 The Unified Social Contribution (USC) covers mandatory contributions for:

pension insurаnce,

unemployment insurance,

temporary disability benefits,

insurance against workplace accidents or occupational diseases.

USC payers are required to contribute 22% of the payroll base (wages, compensation for completed work, or services provided).

An employee’s right to social protection depends on the payment of USC and the accumulated insurance record, which determines eligibility for:

🔹 pension benefits;

🔹 sick leave payments;

🔹 unemployment benefits;

🔹 benefits in case of occupational injury or disease.

‼ Check your employment status, the timeliness and completeness of your insurance contributions, and the duration of your insurance record on the web portal of the Pension Fund of Ukraine 🌐 https://portal.pfu.gov.ua.

📌 Learn how to obtain electronic certificates with a QR code (such as income for pension calculation, insurance record, pension amount, etc.) ➡ https://t1p.de/u9g5p.