The Ministry of Finance of Ukraine, together with the State Tax Service, is conducting a communication campaign called "Taxes Protect." A series of infographics and videos describe various real-life situations that will teach you about:

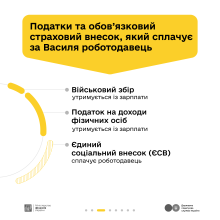

- the most common tax situations for Ukrainian citizens and the corresponding taxes,

- the procedure for paying them and their distribution between the state and local budgets,

- where the state spends the taxes paid by citizens,

- the consequences of tax evasion.

Read about a real-life situation – how Vasyl, an employee, pays taxes on his income at a construction company.

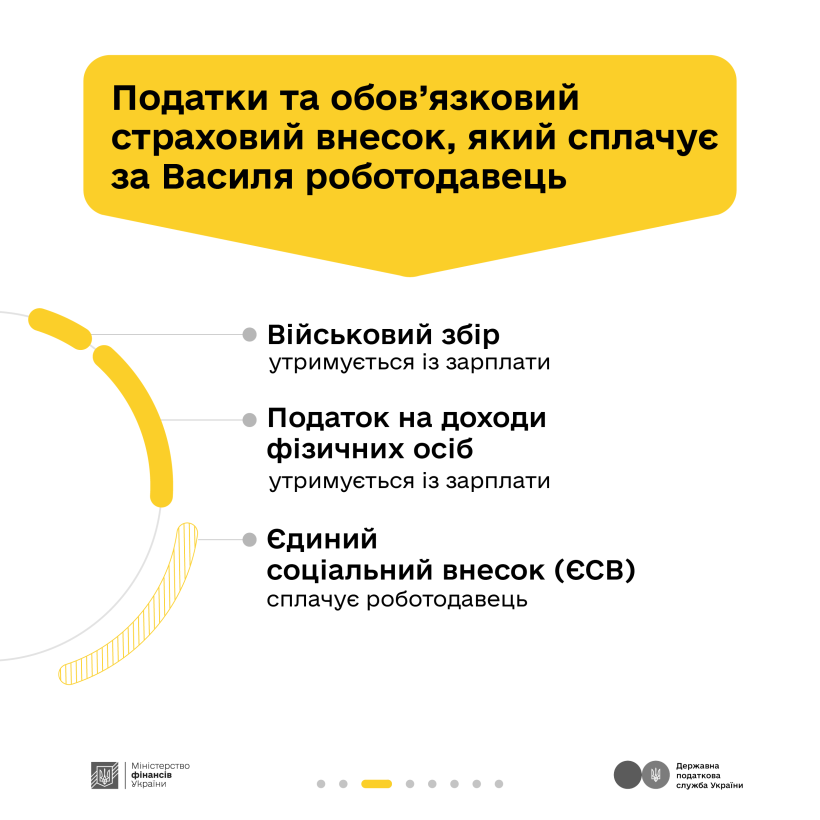

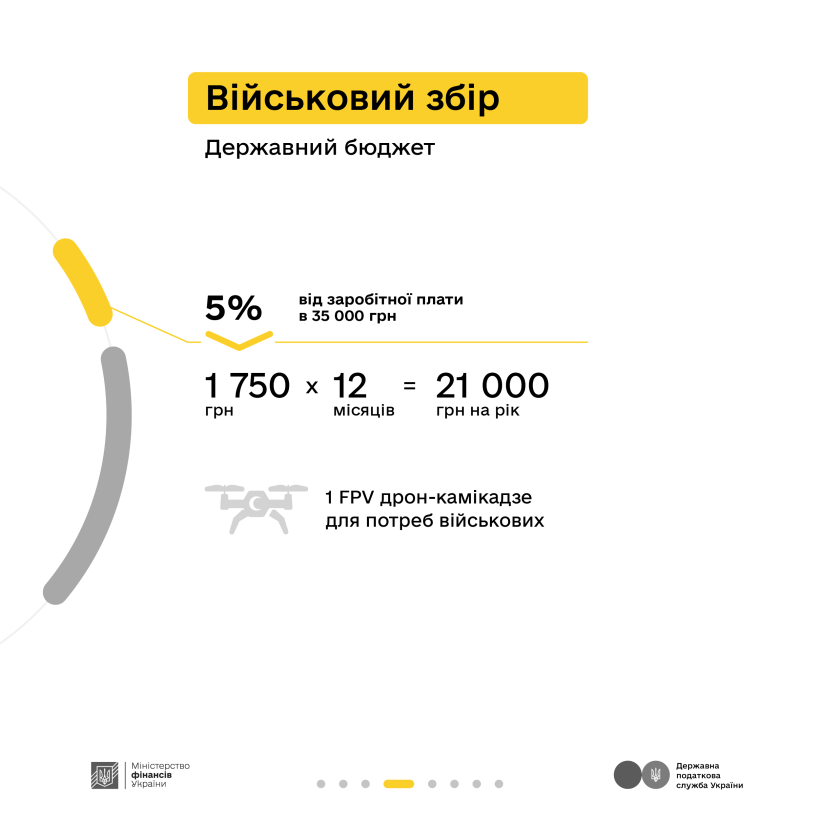

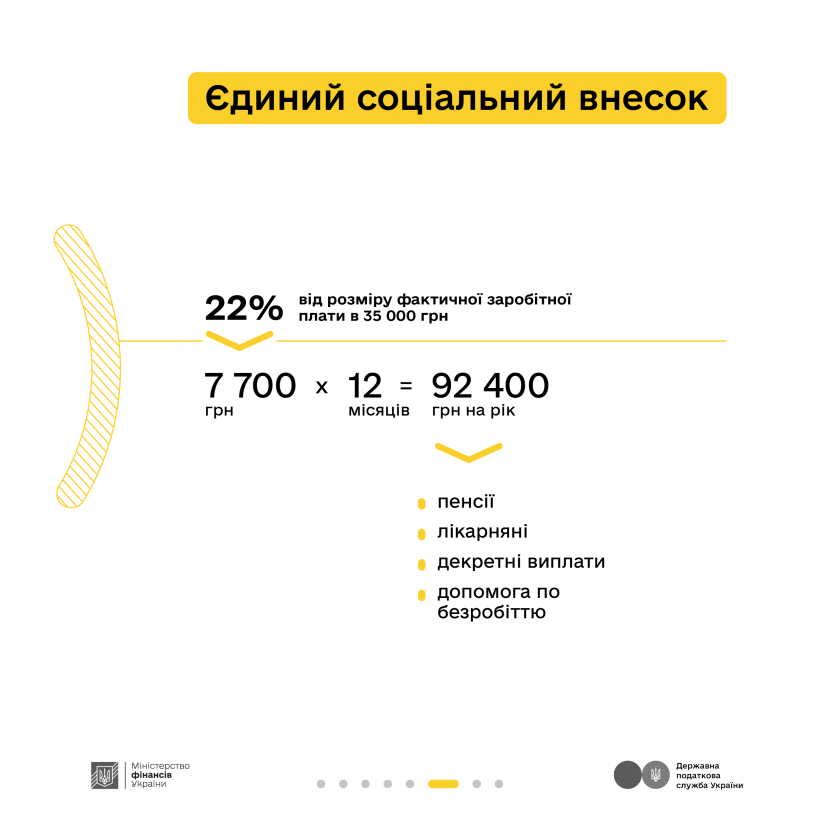

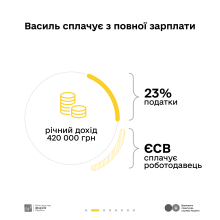

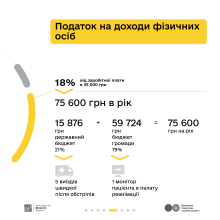

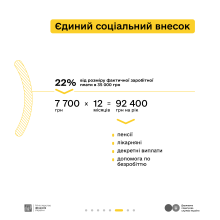

Imagine Vasyl. At 48, he works as an architect at a construction company. Vasyl is officially employed under an employment contract and pays taxes on his full, "white" salary. His monthly income before taxes is 35,000 UAH (105,000 UAH/quarter, 420,000 UAH/year). After taxes, he receives 26,950 UAH.

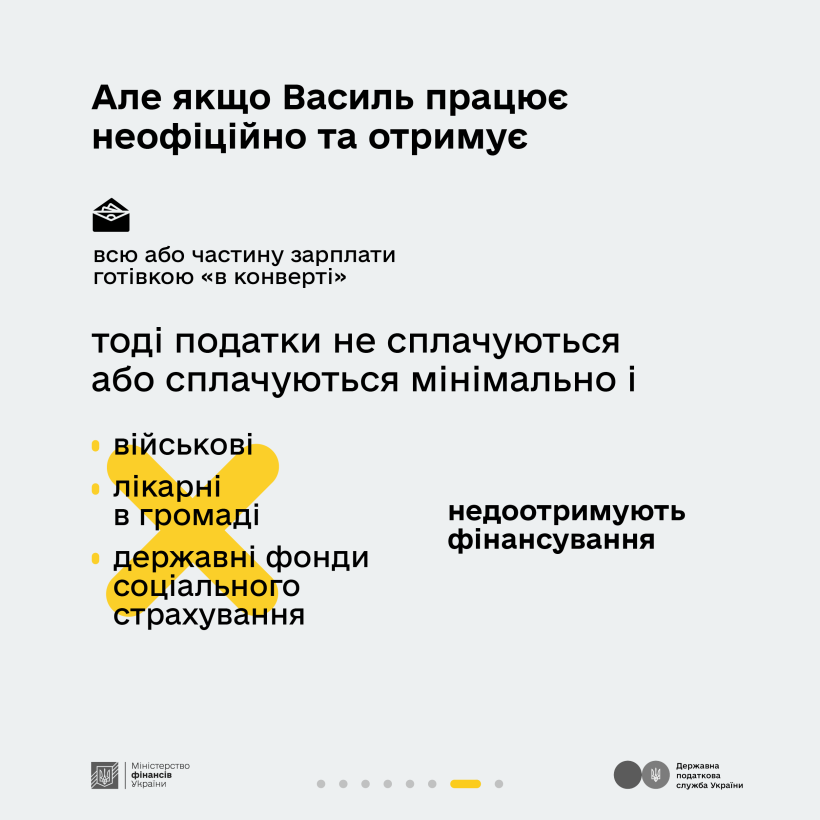

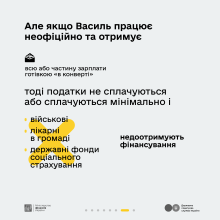

If Vasyl is employed without an employment contract and receives all or part of his salary "in an envelope," in cash, then taxes will not be paid or will be paid at a minimum. Then:

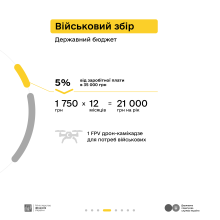

- the military will not be able to defend their positions without kamikaze drones,

- it will be impossible to monitor the condition of patients in intensive care,

- state social insurance funds will not be replenished, and therefore Vasyl will not receive social insurance and corresponding payments if necessary.

Taxes protect. Help with your contribution!