The Ministry of Finance of Ukraine, together with the State Tax Service, is conducting a communication campaign called "Taxes Protect." A series of infographics and videos describe various real-life situations that will teach you about:

- the most common tax situations for Ukrainian citizens and the corresponding taxes,

- the procedure for paying them and their distribution between the state and local budgets,

- where the state spends the taxes paid by citizens,

- the consequences of tax evasion.

Read about a real-life situation and find out what taxes Maxim, a designer from Lviv, pays on his additional income from renting out his apartment.

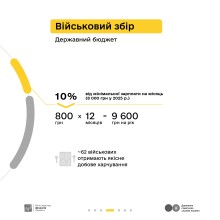

23-year-old Maxim works as a designer at an agency in Lviv. He rents out his apartment in Uzhhorod for 15,000 UAH per month (45,000 UAH per quarter; 180,000 UAH per year). To legalize his additional income, Maksym registered his activity as a sole proprietor (individual entrepreneur) of group 2. This allows him to officially provide rental services to Ukrainian citizens and single tax payers (i.e., other sole proprietors and LLCs).

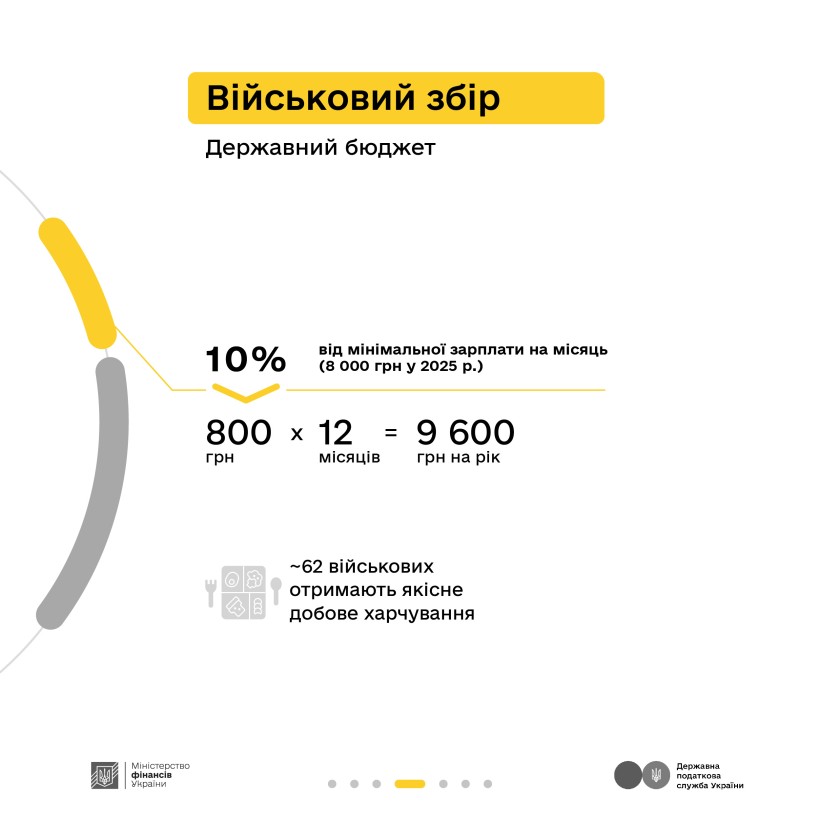

Once a year, Maxim submits a tax return through the Electronic Taxpayer's Office on the State Tax Service web portal. Every month, he pays military tax and single tax. Maksym pays the other two taxes (18% personal income tax and 5% military tax) and the single social contribution as an employee of the agency.

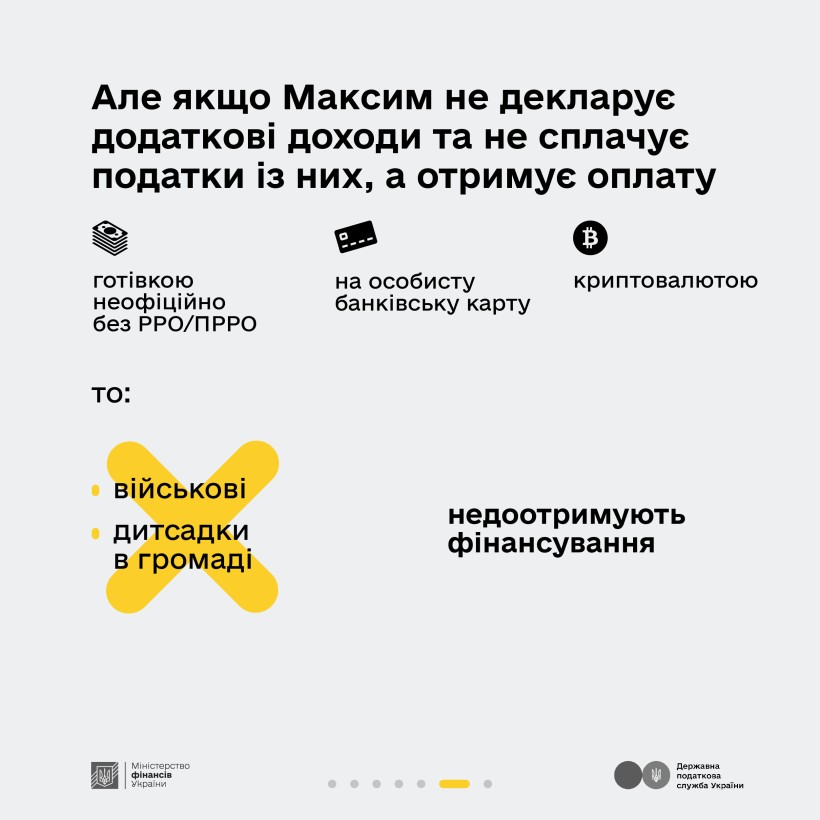

If Maxim receives rent payments to his personal bank card, in cryptocurrency, or in cash, and does not pay income tax, then:

- the military will not have quality daily meals,

- children in kindergarten will be left without hot lunches.

Taxes protect. Help with your contribution!